In this article, I will be explaining every detail about the GST invoice, including who has to create it, what are the mandatory fields, and when a GST invoice should be created. Let’s start with the basics. GST invoice It is a detailed statement with the information about any service provided or goods supplied by […]

You might be aware that fake invoicing is one of the most significant issues faced by the tax authorities in India. Fake invoices are generated for tax theft and frauds. GST e-invoicing is a promising mechanism that might help put an end to this issue. In this piece of information, I’ll be talking about […]

The Input Tax credit, generally referred to as ITC, is an option available to reclaim credits on the Input tax paid for the purchase of some goods or services. This credit can be used to settle any outstanding output tax by the taxpayer. It is one of the most beneficial features of GST law that […]

Goods and Service Tax (GST) came into force on 1st July 2017. It is considered as one of the most crucial Tax Reforms in the nation. It is an indirect tax levied on multiple goods and services. The goal of GST is to eliminate the cascading effect of various taxes that existed before its introduction. […]

If you are brainstorming whether to choose the Composition Scheme or not, you are at the perfect place! In this article, I will be discussing the composition scheme to help you decide whether you should choose the composition Scheme under GST or not. What is the Composition Scheme under GST? GST mechanism might prove a […]

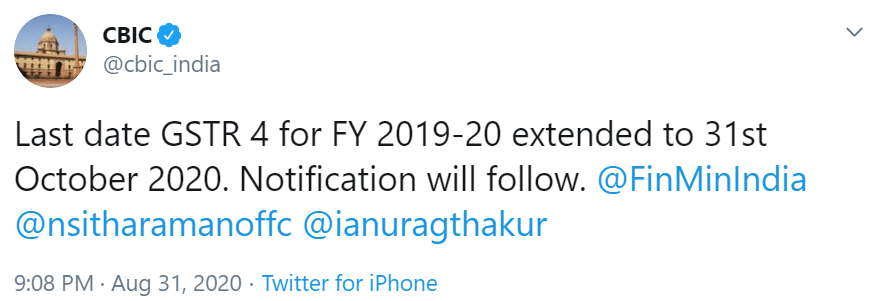

As per the recent tweet of the Central Board of Indirect Taxes and Customs (CBIC), the Last date for filing Form GSTR 4 for the FY 2019-20 has been extended to October 31, 2020. Note: The notification will be issued shortly in this regard. Source: https://twitter.com/cbic_india/status/1300457845184368640?s=20

GSTN has enabled Form GSTR 2B in the GST Portal. The Taxpayer can log in with there login credentials then go to F.Y. 2020-21 for July 2020, the Form GSTR-2B is available on the Portal. Source: GST Portal

GST was introduced on 1st July 2017 amid many debates and skepticism. It replaced 17 existing local & central taxes and gave freedom from their cascading effect. But even after three years of the introduction, every now and then, some issue racks up and create a problem for taxpayers and businesses. The same story repeated […]