If you are brainstorming whether to choose the Composition Scheme or not, you are at the perfect place! In this article, I will be discussing the composition scheme to help you decide whether you should choose the composition Scheme under GST or not. What is the Composition Scheme under GST? GST mechanism might prove a […]

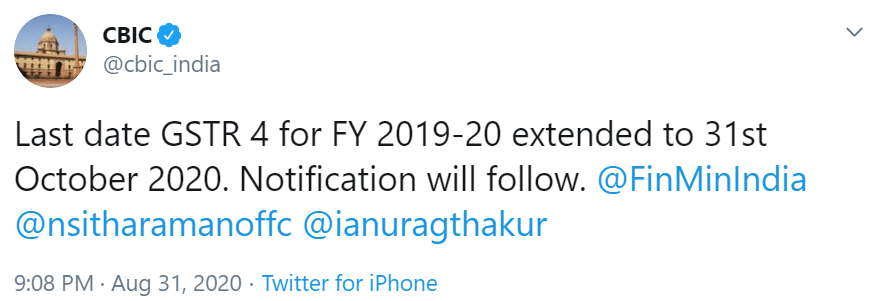

As per the recent tweet of the Central Board of Indirect Taxes and Customs (CBIC), the Last date for filing Form GSTR 4 for the FY 2019-20 has been extended to October 31, 2020. Note: The notification will be issued shortly in this regard. Source: https://twitter.com/cbic_india/status/1300457845184368640?s=20

GSTN has enabled Form GSTR 2B in the GST Portal. The Taxpayer can log in with there login credentials then go to F.Y. 2020-21 for July 2020, the Form GSTR-2B is available on the Portal. Source: GST Portal

GST was introduced on 1st July 2017 amid many debates and skepticism. It replaced 17 existing local & central taxes and gave freedom from their cascading effect. But even after three years of the introduction, every now and then, some issue racks up and create a problem for taxpayers and businesses. The same story repeated […]