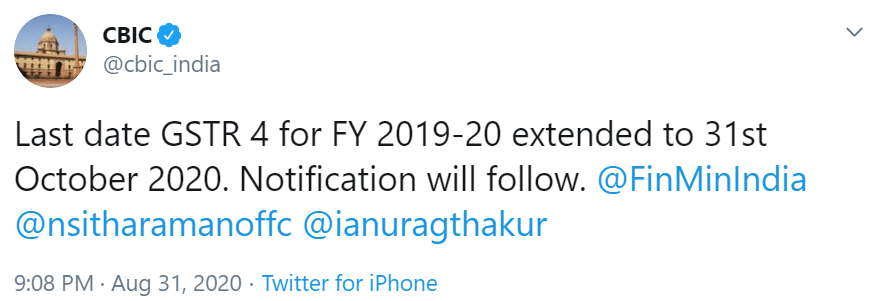

As per the recent tweet of the Central Board of Indirect Taxes and Customs (CBIC), the Last date for filing Form GSTR 4 for the FY 2019-20 has been extended to October 31, 2020. Note: The notification will be issued shortly in this regard. Source: https://twitter.com/cbic_india/status/1300457845184368640?s=20

Udyam (earlier known as Udyog Adhaar) is a registration certificate for the MSMEs, that can be obtained from the Udyam registration portal by self-declaring all the necessary information. As per the Government’s notification, Udyam registration will be mandatory for all those who are willing to establish their Micro, Small or Medium enterprise. Upon Registration, these […]

GSTN has enabled Form GSTR 2B in the GST Portal. The Taxpayer can log in with there login credentials then go to F.Y. 2020-21 for July 2020, the Form GSTR-2B is available on the Portal. Source: GST Portal

Income Tax Return (commonly referred to as ITR) is a self-declaration made by the taxpayer regarding his/her income, deductions, and tax payable. As per the law, it is mandatory to file an ITR if your annual income exceeds 2.50 lakh. But due to ignorance and less awareness about the benefits of filing ITR, people fail […]

GST was introduced on 1st July 2017 amid many debates and skepticism. It replaced 17 existing local & central taxes and gave freedom from their cascading effect. But even after three years of the introduction, every now and then, some issue racks up and create a problem for taxpayers and businesses. The same story repeated […]